Wyhy Can Be Fun For Anyone

Wiki Article

The 10-Second Trick For Wyhy

Table of ContentsAll About WyhyOur Wyhy PDFsThe 7-Minute Rule for Wyhy4 Simple Techniques For WyhyThe Main Principles Of Wyhy How Wyhy can Save You Time, Stress, and Money.

Longer terms can reduce up the funding. It will certainly be easy to return the finance, and you will certainly have a longer time for it. You will need to pay lower regular monthly settlements for the watercraft car loan due to the fact that credit score deals longer terms for boat finances than neighborhood banks, so that regular monthly settlements will certainly be reduced.

A boat loan can be made use of to fund additional electronic tools. It will certainly be advantageous for you to buy new items for the watercrafts to make your time on the water simple.

Indicators on Wyhy You Should Know

Utilized watercraft loans may occasionally have higher rates than new watercrafts, it is not constantly the instance. Explore present prices and use a finance calculator to estimate your finance settlement."There are pitfalls, or 'shoals' as we like to claim, in watercraft funding, but that's where we succeed, at navigating the ins and outs and discovering any kind of hidden risks," said Rogan. "As an example, in some cases there is a concern with transfers between previous owners, or we might have to do a title search with the Shore Guard.

Wyhy for Dummies

"There are no tricks when it pertains to getting approved for a watercraft loan, however there are some techniques that we can use to make certain your monetary situation is stood for properly," noted Rogan. "We have actually dealt with much of the same lenders for several years and recognize what they are trying to find and just how to see to it that your information exists in the very best feasible light." The very best option for a watercraft funding is usually a marine lender that focuses on boat financings."Lenders who specialize in boat financings normally have a better understanding of watercrafts and their customers," claimed Rogan. Watercraft financings made use of to be more minimal in length and with bigger down settlements; today, terms of 10 to 20 years are rather typical.

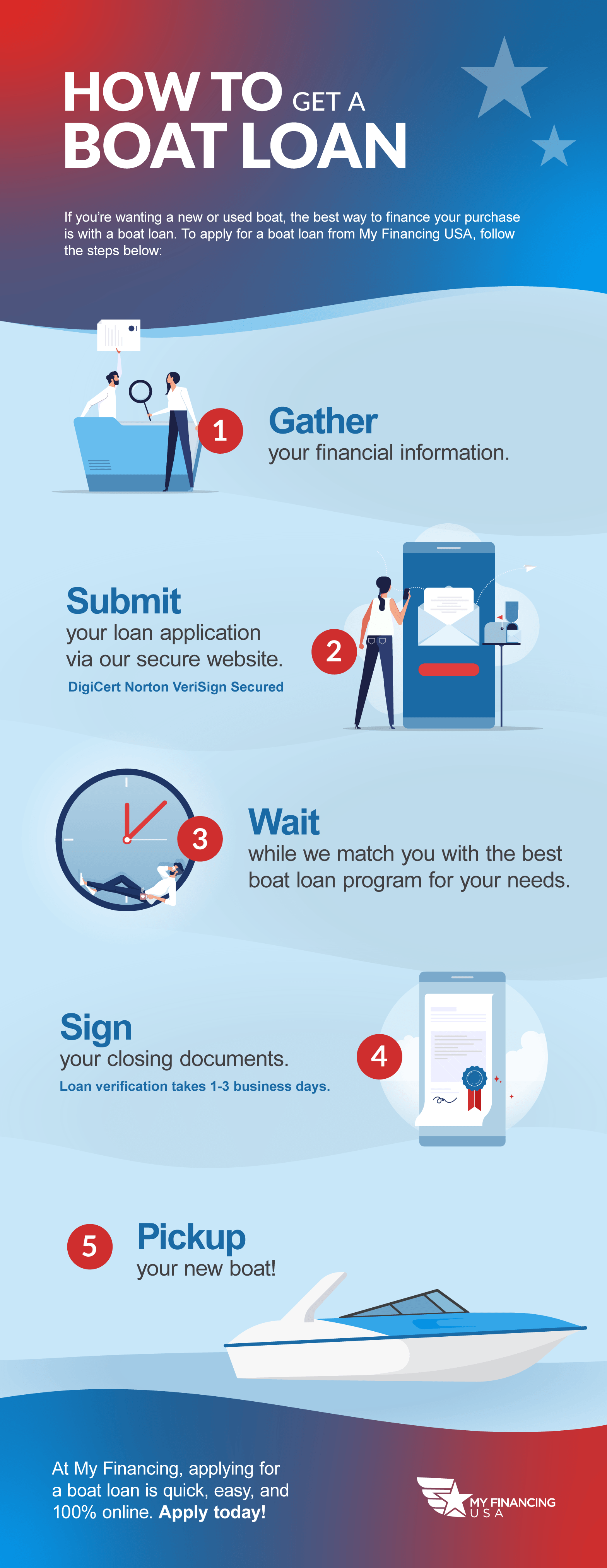

Determine and value the specific watercraft you want. Determine and price the boat insurance coverage you need. Launch the acquisition. If it seems straightforward, well, that's because it is. The majority of brand-new watercrafts are purchased with a car loan, so reputable treatments remain in location. When it comes to who to get the car loan from, you'll have three fundamental alternatives to pick from: This is normally the very best wager.

Not known Details About Wyhy

They can typically assist with some recommendations for establishing insurance coverage, also. Some buyers who have a great deal of equity in their home discover it useful to take out a home equity finance or a bank loan, either since they may get a lower rate of interest or for tax obligation functions., made up of loan providers who are acquainted with all the ins and outs of making boat car loans. When you obtain your boat loan, simply what will the repayments be?

Some Known Factual Statements About Wyhy

Credit rating, financial debt ratios, and net well worth might all be thought about by the lender, basically depending on your my latest blog post individual scenarios and the size and term of the loan. Nonetheless, there are a few generalities that apply for the substantial bulk of watercraft financings: Passion rates normally decrease as the lending amount rises.Generally, the lending institution will certainly be basing a watercraft financing on a 10- to 20-percent down-payment. Frequently, you can roll the expenditures of devices like electronic devices, trailers, and also prolonged guarantees into a boat lending.

Unknown Facts About Wyhy

Most lenders will certainly be seeking credit report of about 700 or greater. You can get a boat loan with a reduced debt rating, but anticipate that you may need to pay a charge in the form of a greater rates of interest or a larger down-payment. Make certain to check out Funding & Boat Loans: Helpful Details for Boat Possession to read more concerning a few of the finer factors of funding a boat.

Obtaining a loan to purchase a boat is a lot like taking out a car loan to purchase a cars and truck or a home. You can obtain a protected boat funding that uses the boat as collateral or an unsecured car loan that will carry a greater rate of interest and a reduced borrowing limit.

Report this wiki page